Since its founding in 2018, Sycamore has emerged as a standout fintech in Nigeria, an organisation with the ambition and agility to democratise finance for individuals and small businesses.

From a startup launched in a founder’s living room, it has grown steadily, carving a vibrant niche in peer-to-peer lending, savings and investment innovation, all the while reinforcing its credentials with strong regulatory compliance and technology-driven service.

Led by Co-founders Babatunde Akin‑Moses (CEO), Mayowa Adeosun (COO) and Onyinye Okonji (CCO), Sycamore started as a solution to a simple but pervasive problem: many Nigerians operate side-businesses or freelance and find it hard to access credit despite earning income.

The founders recognised this gap and built a platform to address it.

In its early days the venture was lean: the trio used their savings to start and built operations from limited space. They prioritised profitability, focusing on small business and individual loans, and by year two the company achieved cash-flow positive status.

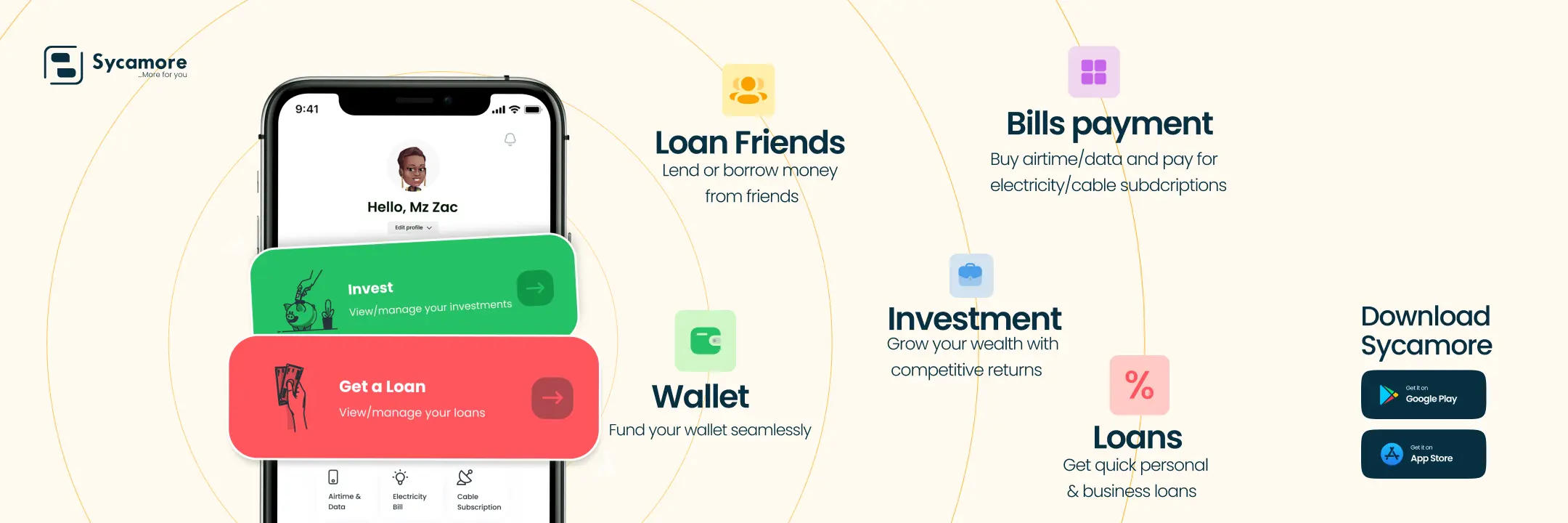

Today, Sycamore offers a full suite of financial solutions: personal and business loans, savings and investment products, and bill payment/neo-banking features—all via its mobile-first platform.

The company reports disbursing more than ₦22 billion in loans and serving hundreds of thousands of users.

Discover more from moi awards

Subscribe to get the latest posts sent to your email.