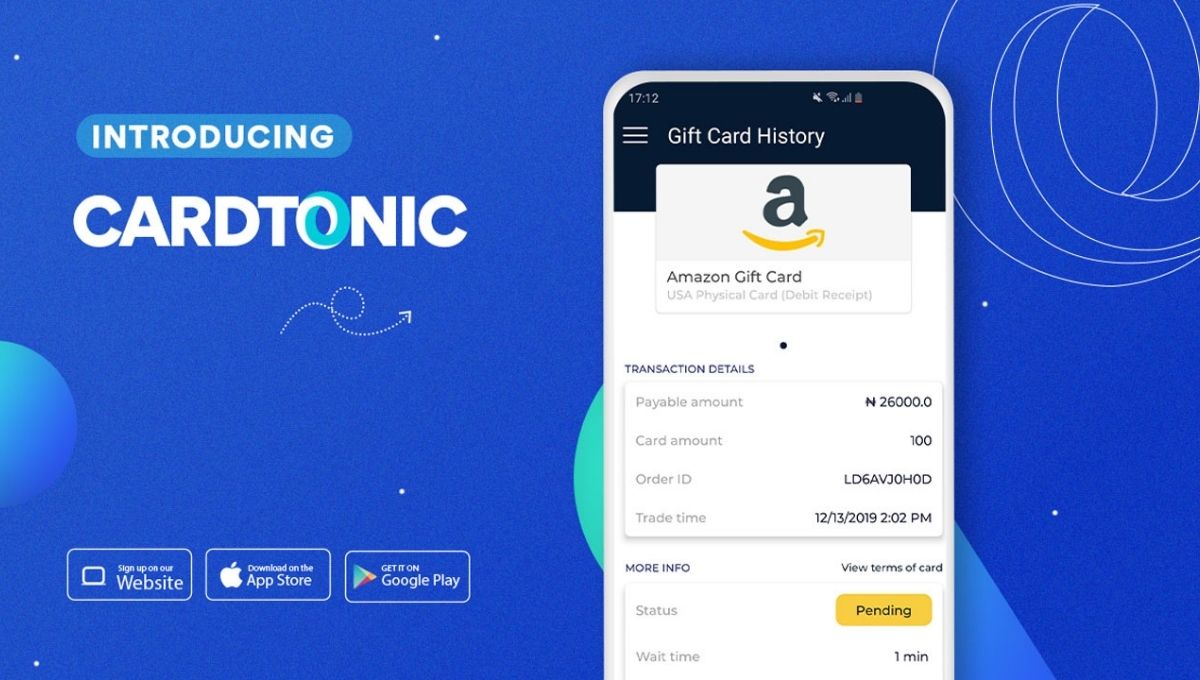

Cardtonic has become a household name in Nigeria’s fast-growing fintech space. The platform allows users to buy and sell gift cards, pay bills, purchase gadgets, and get virtual dollar cards, all in one place. But behind its sleek app and social media presence lies a story of innovation, risk, and resilience.

Founded in 2019 by Balogun Usman and Kayode Faturoti, Cardtonic, under its parent company The Tonic Technologies began as a cryptocurrency trading app. Over time, the founders saw a bigger problem:

Nigerians were receiving gift cards from relatives abroad that they couldn’t use. Many of these cards, like Nike or Amazon vouchers, ended up wasted. Cardtonic stepped in to solve that.

The company built a system that lets users trade their unused or inaccessible gift cards for cash. Once a user submits a card, Cardtonic validates it and sells it to verified partners who pay real money in return. Some cards, called “fast cards,” can be cashed out in less than ten minutes, a major attraction for users looking for quick payouts.

By 2025, Cardtonic had grown rapidly, claiming over one million registered users, with around 600,000 active monthly traders. In January of that year, Emmanuel Sohe was appointed CEO to lead its next growth phase.

The company now processes over 400,000 gift cards monthly, showing how a simple

idea has turned into a thriving business.

However, Cardtonic’s journey hasn’t been smooth. The gift card market is risky and unpredictable. Some cards are invalid or already used, while others have damaged codes that can’t be redeemed.

The company maintains a dedicated team to check every card before payment, ensuring that users get value and scammers are kept out.

Fraud is also a daily challenge. Scammers pretend to be staff, steal codes, or hack user accounts. Cardtonic fights back with two-factor authentication, user education, and strict verification before any payout.

The company’s business model is based on buying gift cards at a discount and reselling them at a markup. Profits depend on trade volume and the gap between buy and sell rates, a gap that fluctuates with exchange rates and demand cycles. A sudden swing in the naira-dollar rate can turn profits into losses, which makes constant monitoring essential.

Unlike most fintech startups chasing funding, Cardtonic has remained self-funded and profitable. Its team of about 120 employees manually verify trades and handle customer issues, a more hands-on approach than most automated fintech platforms.

Discover more from moi awards

Subscribe to get the latest posts sent to your email.